Virginia Hospitals

CJW Medical Center

General Info

Our General Information includes locations, prices, facility size and other information to get you started comparing facilities.

Address:

7101 Jahnke Road

Richmond, VA 23225

Get Directions

(804) 483-0000

Administrator:

Lance Jones

CEO

For Consumer Inquiries:

Dustin Fosness (CFO)

dustin.fosness@hcahealthcare.com

(804) 483-0813

7101 Jahnke Road

Richmond, VA 23225

Get Directions

(804) 483-0000

Administrator:

Lance Jones

CEO

For Consumer Inquiries:

Dustin Fosness (CFO)

dustin.fosness@hcahealthcare.com

(804) 483-0813

Medicare Provider Number: 490112

Parent Company: HCA Healthcare Capital Division

Tax Status: Proprietary

Teaching Status: None

Facility Comments: CJW Medical Center is comprised of the Chippenham campus on Jahnke Rd and the Johnston-Willis campus at 1401 Johnston-Willis Drive. See www.healthgrades.com for list of America's 50 Best Hospitals. Working Mother magazine-named one of the Top 100 Companies for Working Mothers. Ranked Best (#1) in Virginia for Heart Surgery – 2007-Healthgrades. Ranked Best (#1) in Virginia for Cardiology Services – 2007-Healthgrades. Only Hospital in the Richmond Area to Receive the HealthGrades 2006/2007 Maternity Care Excellence Award™. Ranked Among the Top 10% in the Nation for Overall Pulmonary Services for 2 years in a row – 2006-2007-Healthgrades. Recipient of HealthGrades Distinguished Hospital Award for Clinical Excellence™ four years in a row (2003-2006)

Hospital Stays

For Fiscal year 1/1/2022 - 12/31/2022

Virginia Trauma System

Level I Virginia Designated Trauma Center

Level I trauma centers have an organized trauma response and are required to provide total care for every aspect of injury, from prevention through rehabilitation. These facilities must have adequate depth of resources and personnel with the capability of providing leadership, education, research, and system planning.

Updated on: 12/14/2023

Efficiency Indicators

For Fiscal Year 1/1/2022 - 12/31/2022

Composite Score (Lower is better)

More efficient

1.3

Less efficient

3.7

Charges

| Indicator Description | Quartile Rank 1 through 4 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

1 Gross Revenue Per Adjusted Admission: The average full patient charge based on charge schedules per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

21,692.98

193,558.31

.

193,558.31

|

|||||||||||||||

|

2 Net Revenue Per Adjusted Admission: The average dollar amount expected to be collected per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

7,716.68

21,154.33

.

25,835.32

|

Costs

| Indicator Description | Quartile Rank 1 through 4 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

3 Cost Per Adjusted Admission: The average total operating costs (adjusted by the wage index) per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

6,672.34

16,432.28

.

27,508.20

|

|||||||||||||||

|

4 Labor Cost Per Adjusted Admission: The average personnel expenses (adjusted by the wage index) per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

2,014.77

6,046.44

.

14,983.07

|

|||||||||||||||

|

5 Non-labor Cost Per Adjusted Admission: The average supply, maintenance and non-personnel expenses (adjusted by the wage index) per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

3,035.68

7,117.93

.

16,005.15

|

|||||||||||||||

|

6 Capital Cost Per Adjusted Admission: The average physical facility costs (e.g., expenses for depreciation, amortization, interest, insurance and taxes as related to the acquisition of permanent assets) per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

-854.20

1,066.55

.

2,186.03

|

Productivity/Utilization

| Indicator Description | Quartile Rank 1 through 4 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

7 Full-time Equivalents Per Adjusted Occupied Bed: The number of staff, converted to the average number of employees who work full time, for each occupied bed. The number of occupied beds has been adjusted to account for outpatient service revenue and case mix. The desired direction is toward a lower value.

|

0.51

2.76

.

8.39

|

|||||||||||||||

|

8 Paid Hours Per Adjusted Admission: The average number of hours the hospital paid to employees or an agency, per adjusted admission. Admissions are adjusted for case mix and outpatient service revenue. The desired direction is toward a lower value.

|

23.64

110.26

.

215.47

|

|||||||||||||||

|

9 Staffed Beds Occupancy: Expressed as a percentage, the average utilization of the average number of beds, excluding long-term care beds and normal newborn bassinets, that are operational to receive patients during the reporting period. The desired direction is toward a higher value.

|

99.00

64.11

.

12.73

|

|||||||||||||||

|

10 Licensed Beds Occupancy: Expressed as a percentage, the average utilization of the number of licensed beds reported by the facility, as approved by the Virginia Department of Health. For hospitals, licensed beds exclude normal newborn bassinets, but include neonatal ICU bassinets. The desired direction is toward a higher value.

|

90.90

67.50

.

6.26

|

|||||||||||||||

|

11 Special Services Utilization: Expressed as a percentage, the average utilization of high capital-cost services that are subject to Certificate of Public Need (COPN) law. Special services include: ICU/CCU, obstetrics, neonatal ICU, MRI, CT, lithotripsy, cardiac catheterization, radiation therapy and cardiac surgery. The desired direction is toward a higher value.

|

121.20

66.78

.

22.72

|

|||||||||||||||

|

12 Case-mix Adjusted Average Length of Stay: The average number of days a patient stays in the hospital, adjusted for case mix using the current version of the 3M APR-DRGs. The desired direction is toward a lower value.

|

3.17

6.30

.

12.96

|

Financial Viability

| Indicator Description | Quartile Rank 1 through 4 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

13 Cash Debt Coverage: A measure of the facility's ability to generate cash to cover its long-term debt. The desired direction is toward a higher value.

|

2,070.53

2,070.53

.

-279.11

|

|||||||||||||||

|

14 Total Margin: Total margin expresses the difference between total revenue and cost as a proportion of total revenue. The desired direction is towards a higher value.

|

52.51

26.17

.

-43.56

|

|||||||||||||||

|

15 Return on Assets: Expressed as a percentage, the facility's ability to generate cash on its financial resources (e.g., investments, receivables, inventory, physical plant, etc.) The desired direction is toward a higher value.

|

30.13

12.12

.

-152.36

|

|||||||||||||||

|

16 Fixed Asset Financing Ratio: The percentage of asset value financed by long-term debt. The desired direction is toward a lower value.

|

0.00

0.03

.

3.98

|

Community Support

| Indicator Description | Quartile Rank 1 through 4 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

17 Charity Care, Bad Debt and Taxes: Expressed as a percentage, the amount of charity care (converted to a cost basis,) bad debt and taxes the facility incurred in relation to its total expenses. The desired direction is toward a higher value.

|

24.27

15.12

.

-6.00

|

|||||||||||||||

|

18 Medicaid Participation: Expressed as a percentage, it is the amount of patient days for patients enrolled in the Medicaid program in relation to total patient days. The number of patient days has been adjusted to account for outpatient service revenue. The desired direction is toward a higher value.

|

46.57

25.38

.

0.74

|

Want all this information and more?

Get the complete current Industry Report on a CD in excel files

Updated on: 12/14/2023

Financial Information

For Fiscal Year 1/1/2022 - 12/31/2022

Why is this important?

Why is this important?

Hospital financial information was originally intended to benefit of large employers and purchasers of care.

However, consumers should know that financially healthy hospitals may be better able to provide charity care and invest in infrastructure, and technology. Rankings on financial measures are found within the Efficiency tab.

However, consumers should know that financially healthy hospitals may be better able to provide charity care and invest in infrastructure, and technology. Rankings on financial measures are found within the Efficiency tab.

Revenue

Expense

Click here for more information on operating and total margins.

Updated on: 12/14/2023

2021 Outpatient Tests and Surgery Report

| Tests and Surgery | Sub Group | Number of Cases Performed in 2021 Cases | Median Charge | Statewide Median Charge |

|---|---|---|---|---|

| Colonoscopy | Diagnostic | 639 | $9,862 | $4,831 |

| Colonoscopy | Therapeutic | 3445 | $17,103 | $6,335 |

| General Laparoscopic Procedures | OTHER | 300 | $98,818 | $32,783 |

| Breast Surgery | Diagnostic |  |

|

$14,344 |

| Breast Surgery | OTHER |  |

|

$26,977 |

| Breast Surgery | Repair/Reconstruction/Cosmetic PXS | 358 | $129,684 | $31,564 |

| Breast Surgery | Therapeutic | 142 | $54,104 | $15,653 |

| Hernia Repair | Children | 30 | $48,978 | $17,870 |

| Hernia Repair | Infants |  |

|

$19,782 |

| Hernia Repair | OTHER | 163 | $61,094 | $19,466 |

| Hernia Repair | Unspecified Age | 159 | $66,241 | $19,103 |

| Liposuction | Trunk Extremity | 15 | $81,722 | $8,231 |

| Facial Surgery | Eyes Only | 9 | $59,744 | $7,749 |

| Facial Surgery | Face & Eyes |  |

|

$6,211 |

| Facial Surgery | Facial Only | 7 | $149,614 | $6,418 |

| Knee Surgery (Arthroscopy) | Knee Surgery (Arthroscopy) | 88 | $67,609 | $19,616 |

| Other Gynecological Procedures | Birth Control | 24 | $66,384 | $29,294 |

| Other Gynecological Procedures | D&C/Removal Fibroids | 384 | $103,070 | $21,326 |

| Other Gynecological Procedures | Fertility Related |  |

|

$20,865 |

| Other Gynecological Procedures | Removal Adhesions | 171 | $115,288 | $28,852 |

| Gallbladder Removal | Cholecystectomy | 577 | $93,157 | $27,001 |

| General Laparoscopic Procedures | General Laparoscopy | 139 | $84,290 | $25,553 |

Find Outpatient Facilities by Location

And learn which procedures are performed

Updated on: 6/13/2023

Patient Satisfaction Survey

Patient Survey Collection Dates: July 2020 - Mar 2021

Released in Jan 26, 2022

Released in Jan 26, 2022

Note: Some quarterly refreshed measures that would have included 1st quarter and/or 2nd quarter 2020 data will not be updated in April 2021 and will continue to display the same data that was reported in October 2020 due to the COVID-19 pandemic. For more information, please reference https://qualitynet.cms.gov/inpatient/notifications (2020-111-IP)

CJW Medical Center's Overall

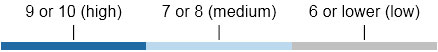

How do patients rate the hospital overall?

Hospital

VA

US

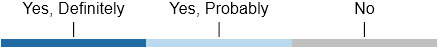

Would patients recommend the hospital to friends and family?

Hospital

VA

US

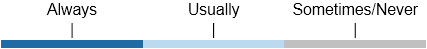

CJW Medical Center's Comfort

How often were the patients rooms and bathrooms kept clean?

Hospital

VA

US

How often did patients receive help quickly from hospital staff?

Hospital

VA

US

How often was the area around patients rooms kept quiet at night?

Hospital

VA

US

How often did nurses communicate well with patients?

Hospital

VA

US

CJW Medical Center's Communication

How often did doctors communicate well with patients?

Hospital

VA

US

How often did staff explain about medicines before giving them to patients?

Hospital

VA

US

Were patients given information about what to do during their recovery at home?

Hospital

VA

US

How did patient understood their care when they left the hospital?

Hospital

VA

US

What Did Patients Say About Their Hospitals?

Compare patients' satisfaction among multiple hospitals

Updated on: 02/02/2022